The Dynamic Interplay Between Industry and Precious Metal Prices

The world of precious metals extends far beyond the realms of jewelry and investment. These metals play a pivotal role in various industries, influencing their market prices significantly. The demand from industries such as electronics, automotive, and renewable energy not only drives the prices but also shapes the future trends in the precious metals market.

This article from Gold Rush Denver aims to explain key components that drive demand for precious metals. If you would like to sell gold in Denver, visit Gold Rush today!

Key Takeaways

- Influence of Industrial Demand on Prices: Industrial usage significantly impacts the pricing of precious metals.

- Impact of Technological Advances: Technological developments can shift demand for certain metals.

- Role of Gold and Silver in Modern Electronics: These metals are crucial in the electronics industry.

- Platinum and Palladium in Automotive Industry: Essential for manufacturing catalytic converters.

- Future Trends and Market Predictions: Evolving technologies and market trends will continue to influence precious metal prices.

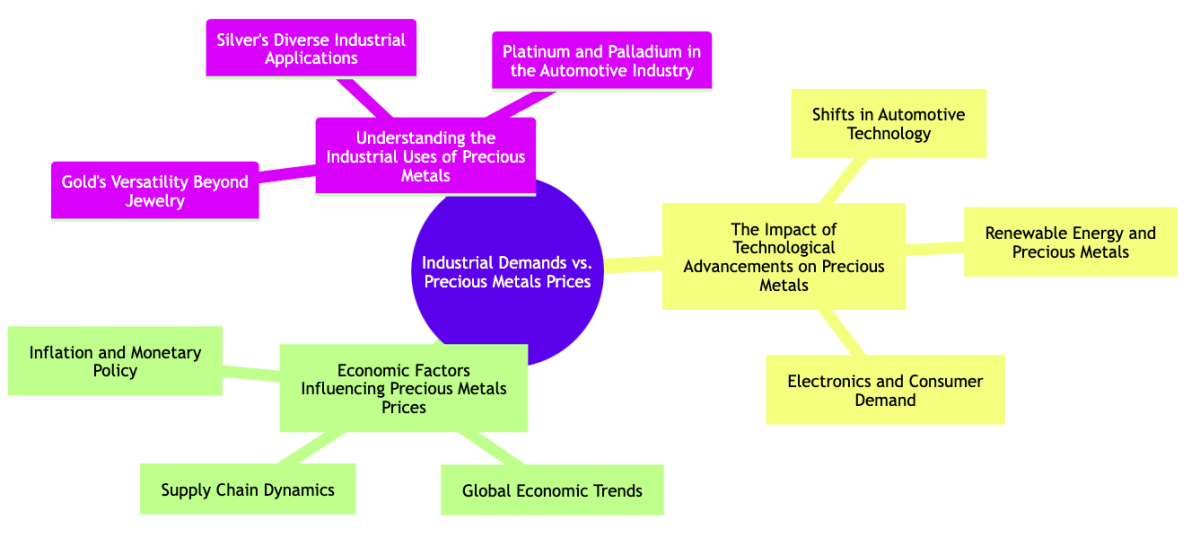

Understanding the Industrial Uses of Precious Metals

Precious metals are not just symbols of wealth and beauty - they are vital components in various industrial applications. Their unique properties make them indispensable in several sectors, directly influencing their demand and market prices.

Gold's Versatility Beyond Jewelry

Gold's role in the industrial sector extends far beyond its glittering presence in jewelry. Its excellent conductivity and resistance to corrosion make it an essential material in electronics, found in almost every modern electronic device, from smartphones to computers. Gold's reflective properties are also utilized in aerospace technology to protect spacecraft from solar radiation. Additionally, its reliability and efficiency have made it a key component in the burgeoning field of renewable energy, particularly in solar panel technology. This diverse range of applications not only underscores gold's versatility but also significantly impacts its demand and value in the global market.

Silver's Diverse Industrial Applications

Silver, known for its lustrous sheen in jewelry, is important in the industrial world due to its unique properties. It is the most electrically conductive metal, making it a vital component in countless electronic devices. Its antimicrobial properties have led to its use in medical devices, offering both sterility and safety. Furthermore, silver's high reflectivity makes it an ideal material for solar panels, playing a crucial role in the renewable energy sector. These wide-ranging applications of silver in key industries not only demonstrate its versatility but also contribute to its steady demand and influence on market prices.

Platinum and Palladium in the Automotive Industry

Platinum and palladium, though distinct, share a common and critical role in the automotive industry. They are essential components of catalytic converters, which reduce harmful vehicle emissions. The demand for these metals is closely tied to the automotive sector's health and regulatory standards on vehicle emissions. As the industry evolves with the rise of electric vehicles, which do not require catalytic converters, the demand dynamics for platinum and palladium are expected to shift, potentially impacting their market value and industrial usage.

The Impact of Technological Advancements on Precious Metals

Technological advancements profoundly influence the demand for precious metals. As industries evolve and new technologies emerge, the roles of gold, silver, platinum, and palladium are continually redefined, leading to significant fluctuations in their market values. These changes are driven by various factors:

- Advancements in Medical Technology: Precious metals are increasingly used in medical devices due to their unique properties. Gold, known for its biocompatibility, is used in dental fillings and cardiac devices. Silver, with its antimicrobial properties, is utilized in surgical instruments and wound dressings. These applications underscore the growing importance of precious metals in advancing medical technology.

- Growth of the Electronics Industry: The electronics industry's expansion has escalated the demand for gold and silver. Gold's superior conductivity and resistance to tarnishing make it indispensable in high-end connectors and circuit boards. Silver, being the most conductive metal, is crucial in switches, contacts, and conductive adhesives. This surge in demand reflects the integral role of these metals in the burgeoning electronics sector.

- Innovations in Aerospace: In the aerospace industry, platinum and palladium play critical roles. Platinum's high resistance to heat is vital in aircraft turbine engines, while palladium is used in hydrogen purification, essential for fuel cells in spacecraft. These applications highlight the strategic importance of these metals in cutting-edge aerospace technologies.

- Renewable Energy Developments: The shift towards renewable energy sources has amplified the demand for silver and gold. Silver's excellent conductivity and reflectivity make it a key component in solar panels, particularly in photovoltaic cells. Gold, with its corrosion-resistant properties, is being explored for use in more efficient and durable solar panels. This trend underscores the growing relevance of precious metals in sustainable energy solutions.

Shifts in Automotive Technology

The automotive industry's pivot towards electric vehicles (EVs) is dramatically altering the demand for platinum and palladium. These metals, traditionally essential for catalytic converters in combustion engines, are facing reduced demand with the rise of EVs, which do not require such converters. However, the potential for these metals in new EV-related technologies, such as in battery and fuel cell applications, suggests a dynamic shift rather than a decline in their industrial importance.

Renewable Energy and Precious Metals

- Solar Panels: Silver's role in solar energy is pivotal, particularly in photovoltaic cells where it's used for conducting electricity.

- Wind Turbines: Precious metals are increasingly being used in wind turbine components, enhancing efficiency and durability.

- Battery Technology: The advancement in battery technology sees gold and silver playing crucial roles, particularly in high-efficiency, long-lasting batteries. Their conductive and corrosion-resistant properties are invaluable in developing more sustainable and effective energy storage solutions.

Electronics and Consumer Demand

The consumer electronics sector's reliance on precious metals is more pronounced than ever. Gold's unmatched conductivity and resistance to corrosion make it a staple in high-performance electronic components. Silver's unparalleled thermal and electrical conductivity is vital in a wide range of electronic devices, from smartphones to large-scale servers. This sustained demand is a testament to the indispensable role of these metals in the rapidly advancing field of consumer electronics.

Economic Factors Influencing Precious Metals Prices

Economic factors play a crucial role in the pricing of precious metals. Inflation, monetary policy, and global economic trends can all have a significant impact on their value.

Economic Factors Impact on Precious Metals

|

Factor |

Gold |

Silver |

Platinum |

Palladium |

|

Inflation |

High sensitivity |

Moderate sensitivity |

Low sensitivity |

Low sensitivity |

|

Monetary Policy |

Direct impact |

Indirect impact |

Varied impact |

Varied impact |

|

Global Trends |

Highly influenced |

Influenced |

Moderately influenced |

Moderately influenced |

Inflation and Monetary Policy

Inflation often drives investors towards precious metals like gold as a hedge. Central bank policies, particularly those related to interest rates and money supply, can also influence precious metal prices, with gold being particularly sensitive to these changes.

Global Economic Trends

Global economic activities, including industrial growth, technological advancements, geopolitical events, and, unfortunately, war, can significantly affect the demand and pricing of precious metals. The interconnectedness of the global economy means that these metals are subject to a wide range of international influences.

Supply Chain Dynamics

Supply chain issues, from mining disruptions to transportation challenges, can greatly impact the availability and cost of precious metals. These dynamics can cause short-term fluctuations in prices and influence long-term market trends.

Conclusion: Navigating the Precious Metals Market

Navigating the precious metals market requires an understanding of the complex interplay between industrial demands, technological advancements, and economic factors. Staying informed about these dynamics is crucial for those looking to invest or trade in precious metals. Gold Rush Denver stands as a knowledgeable ally in this journey, offering expertise and guidance to help clients make informed decisions in the ever-evolving precious metals market. Their commitment to providing up-to-date market insights ensures that clients are well-equipped to navigate this intricate and fascinating market.